Accounts

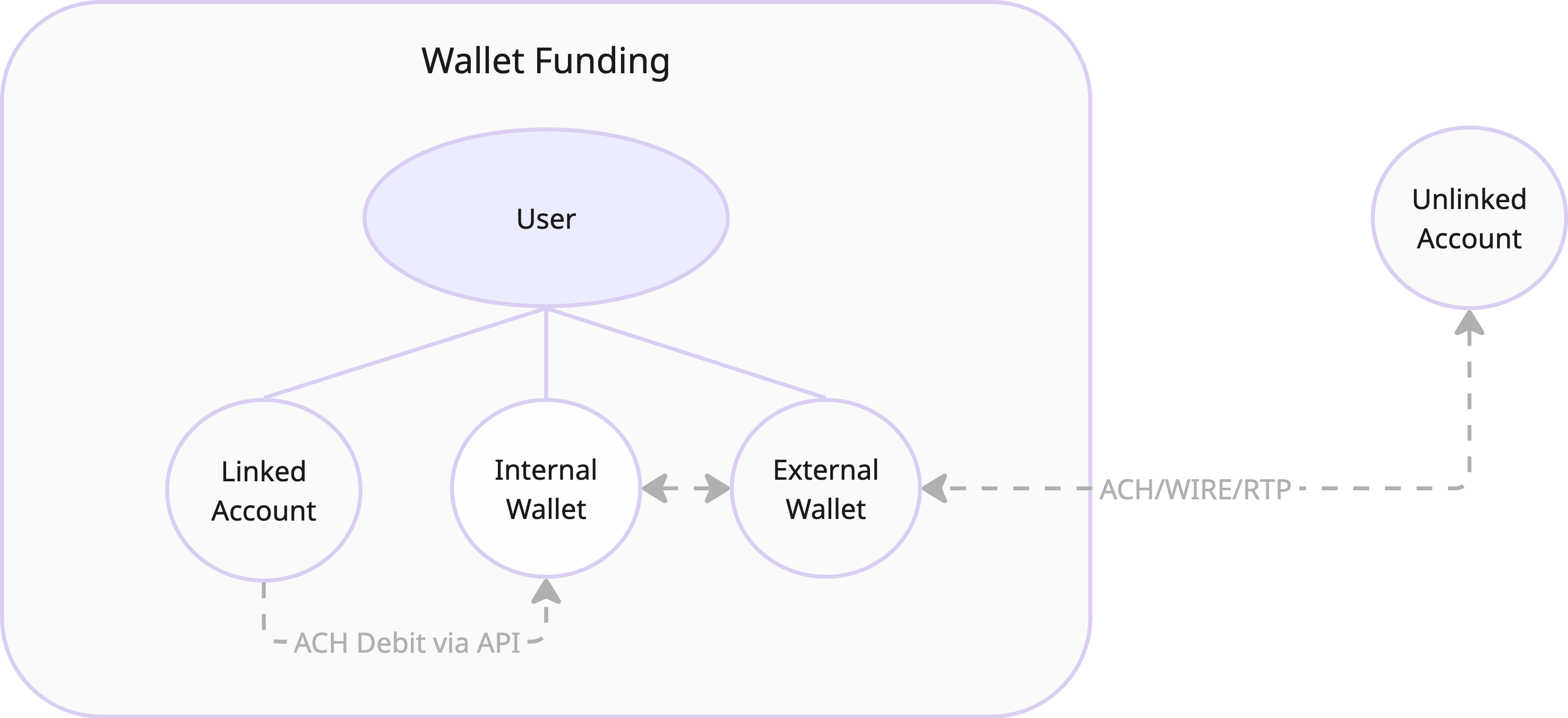

Checkbook facilitates payments through three primary types of accounts: wallets, linked accounts, and unlinked accounts (known as external accounts). Understanding the distinction between these is crucial for effectively managing your funds and payment workflows within the platform.

| Feature | Wallet | Linked Account | Unlinked Account |

|---|---|---|---|

| Location | Held with Checkbook’s banking partners | Held at external financial institutions | Held at external financial institutions |

| Management | Managed through Checkbook | Managed through your bank/credit union | Managed through your bank/credit union |

| Payment Source | Directly from wallet balance | Pulled from account via bank transfer | Pushed from account via wire, ACH, RTP, or FedNow |

| Speed | Instant between Checkbook users | Standard banking processing times | Standard banking processing times |

Wallets

Wallets represent the balance of funds you hold directly within your Checkbook account. Think of it as a digital holding space for your money within our platform to use for sending payments. Wallets come in two types: Internal and External.

Internal wallets do not have any account or routing numbers. They can be funded via API through ACH debits or payments made from other internal and external wallets

External wallets have their own unique account and routing numbers allowing them to be funded externally by ACH, RTP, FedNow, or wire transfer as well as the funding methods mentioned for internal wallets.

Payment Initiation: You can send payments to both internal Checkbook users and external recipients directly from your wallet balance.

Faster Internal Transfers: Transfers between wallets on the Checkbook platform are instant.

Linked accounts

Linked accounts refer to bank accounts and other accounts (e.g. debit cards) that you link to your Checkbook account. These are accounts held at traditional financial institutions outside of the Checkbook platform. When you add your first bank account to Checkbook for billing purposes, you will be adding a linked account. Checkbook interacts with linked bank accounts for billing and sending payments through the ACH network. In order to send payments from these accounts, they must be verified either through instant account verification or manually using microdeposits.

Funding Source: You can link one or more linked bank accounts to your Checkbook account.

Sending Payments: You are able to initiate payments directly from your linked accounts. This requires account verification and will be subject to standard banking processing times.

Receiving Payments: You can provide your linked bank account details to receive payments directly into your bank account.

Unlinked accounts

Unlinked accounts refer to bank accounts held outside of Checkbook that have not been linked to Checkbook. Unlike linked accounts or wallets, Checkbook cannot initiate transactions to or from unlinked accounts. Unlinked accounts can only be used to send funds into a wallet via wire, ACH, RTP, or FedNow. Owners of unlinked accounts are responsible for initiating transfers to wallets via their associated bank interface.