Making Payments

Checkbook’s Marketplace supports flexible fund flows that can be combined to support a wide range of financial experiences. There are three core types of fund movement:

Inbound Payments: Funds into the Marketplace from unlinked accounts

Internal Transfers: Transactions within the Marketplace

Outbound Payments: Transactions from the Marketplace to external parties

Each flow supports different parts of a customer’s user journey—from initial funding to transacting at scale. Designed to be flexible and API-driven, the Marketplace allows you to build the exact payment experience your enterprise needs.

Inbound Funds

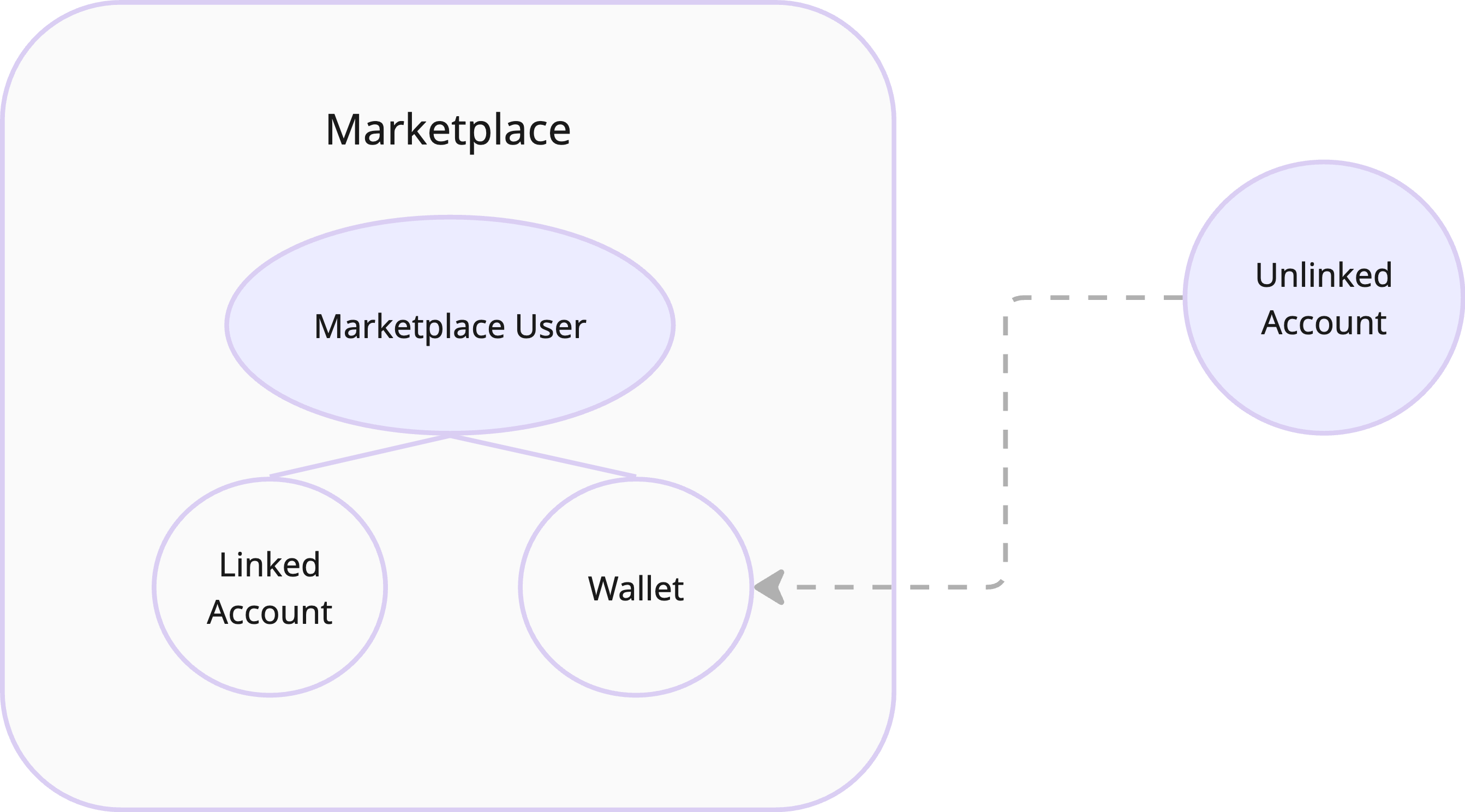

These transactions bring funds into the Marketplace from unlinked accounts, and are typically used to fund wallets.

Supported sender account types: Unlinked accounts

Supported recipient account types: Wallets

Initiated by: External parties (not onboarded to the Marketplace)

How it works: Customers provide external parties with account and routing numbers affiliated with their Checkbook wallet. External parties initiate the transfer from their bank or payment service of choice.

| Supported Inbound Payment | Description |

|---|---|

| ACH | Bank-to-bank transfer via ACH network. |

| RTP | Real-time transfers, 24/7/365. |

| FedNow | Instant payments via the Federal Reserve, 24/7. |

| Wire | Same-day bank transfer with higher fees. |

Internal Transfers

These are internal Marketplace transactions between onboarded users and entities, such as the Marketplace Owner and Marketplace Users. They allow for flexible fund movement within your ecosystem.

Supported sender account types: Checkbook wallets and linked accounts (personal or business)

Supported recipient account types: Checkbook wallets and linked accounts

Initiated by: Marketplace Owner or Marketplace Users

Types of interactions:

-

Marketplace User ↔ Marketplace User

-

Marketplace Owner ↔ Marketplace User

-

Account ↔ Account (within a single user)

Common use cases:

-

Facilitating payments between Marketplace Users

-

Automating onboarding to the Marketplace ecosystem

-

Marketplace Owners managing or disbursing funds on behalf of users

Outbound Funds

These transactions move funds from the Marketplace to external parties using Checkbook’s email recipient experience.

Supported sender account types: Wallets and linked accounts

Supported recipient account types: Linked accounts

Initiated by: Marketplace Owner or Marketplace User

Recipient details required: Email address, phone number, or mailing address

Delivery methods:

-

Digital delivery via email or SMS

-

Paper check mailed to a physical address

How it works: A payment is created by the user and sent to an external party. If digital, the external party is directed to a secure landing page where they can choose a preferred deposit method (e.g., ACH, PayPal, Venmo, Push to Card).