Multi-Party

Multi-party payments are a specialized payment solution designed to streamline the complex payment workflows that require distributing funds to multiple parties within a single transaction. It simplifies the process of disbursing payments to claimants, vendors, contractors, and other stakeholders, ensuring accuracy, efficiency, and compliance.

Many industries, particularly insurance, deal with scenarios where a single event or claim necessitates payments to several recipients. These include:

Insurance Claims: Distributing funds to claimants, repair shops, medical providers, and legal representatives.

Legal Settlements: Dividing settlement amounts among plaintiffs, attorneys, and other involved parties.

Construction Projects: Allocating payments to contractors, subcontractors, and suppliers.

Checkbook’s multi-party payments address these challenges by providing a dedicated platform for managing multi-party payment workflows.

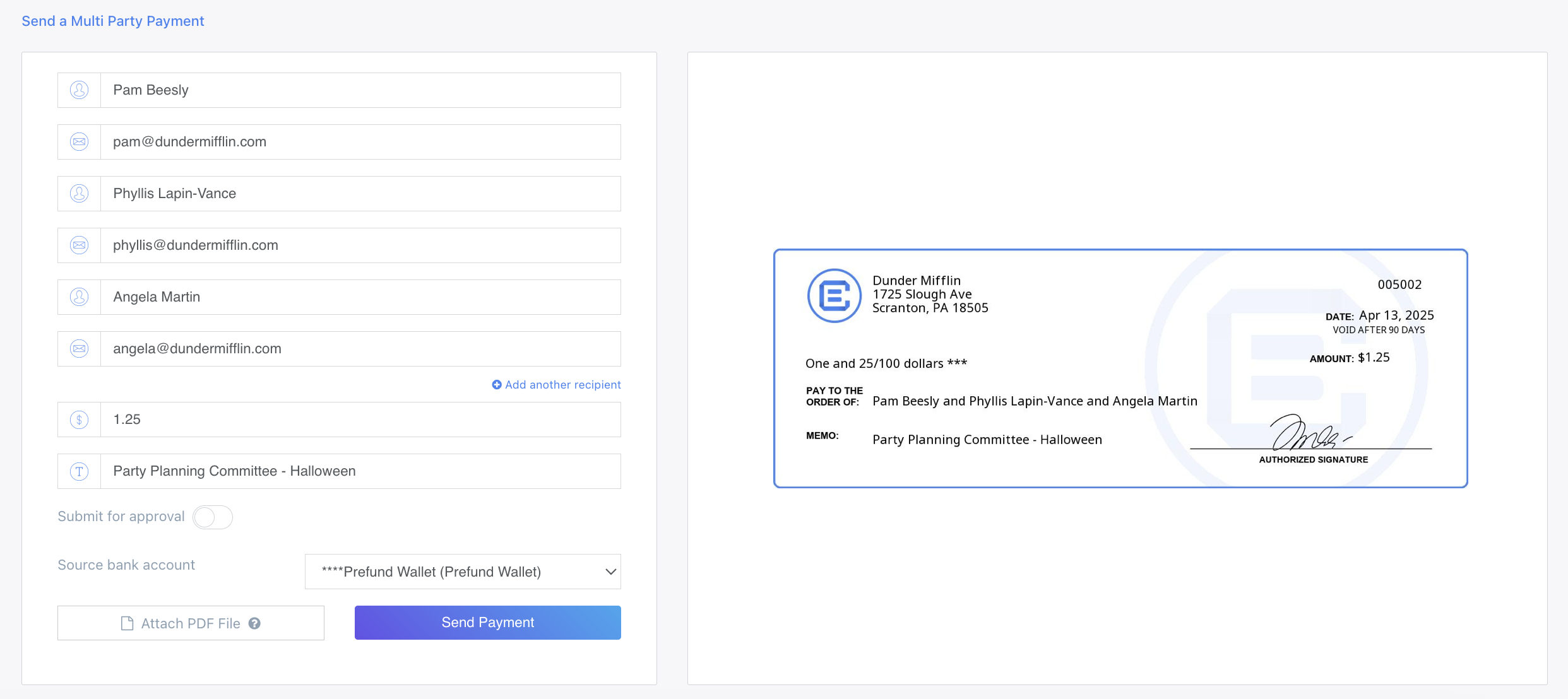

Payment Initiation

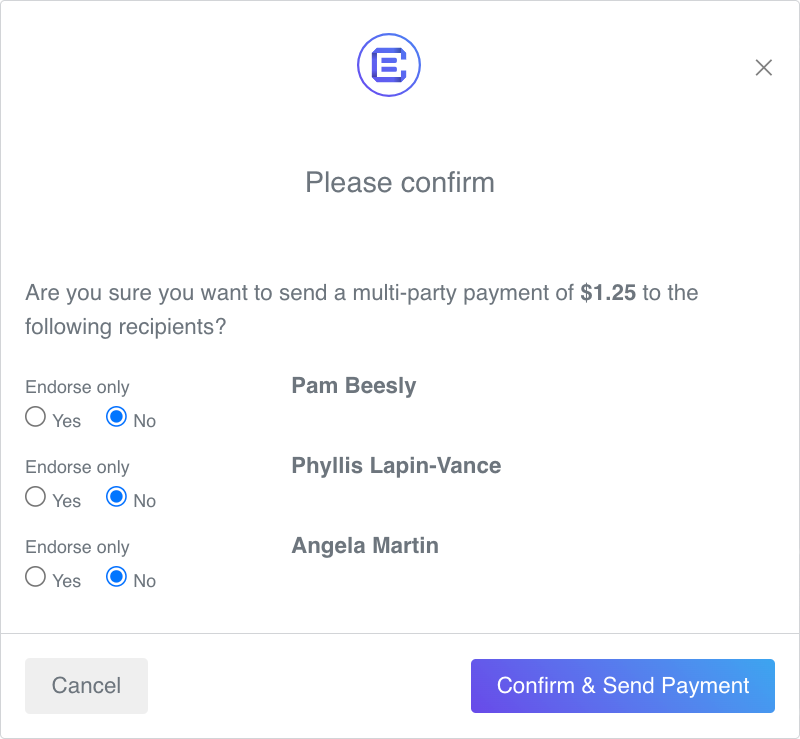

A multi-party payment is created within the dashboard or API by specifying the recipients (identified by email address or phone number), amount, funding source, and other relevant payment information.

By default any recipient can deposit the payment once it has been digitally endorsed by all other parties. However, recipients can be marked as “endorse only” which indicates they can only endorse (and not deposit) the payment.

Checkbook’s multi-party payments support to up to 5 recipients

Recipient Notifications

Any recipients marked as “endorse only” will be notified first, as they are required to endorse the payment before it is eligible for deposit. Once all “endorse only” recipients have completed the digital endorsement process, the remaining recipient(s) will be notified.

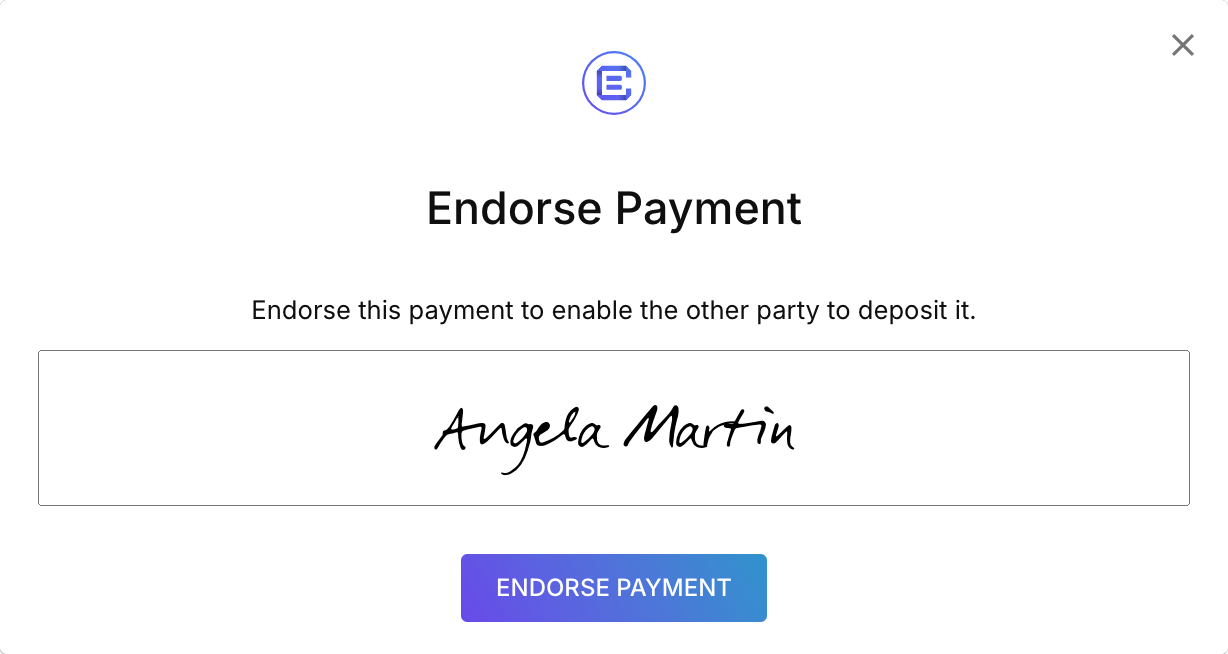

Payment Endorsement

Checkbook’s multi-party payments support a digital endorsement flow, which transfers the right to receive the funds to another party. This digital endorsement process offers a faster, more efficient alternative to traditional paper-based signing processes. Three signature types are supported for the endorsement process:

Typewritten: The endorser types their name into the provided form.

Uploaded: The endorser uploads an image of their signature to the provided form.

Digitized: The endorser signs their name using their computer or mobile device.

Non-”endorse only” recipients can remove the payment from the digital endorsement flow by printing the payment. Once taken out of the digital flow, any remaining endorsements must be completed by signing the paper check before depositing.

Deposit

The funds beneficiary is the recipient of the payment who will be receiving the funds distribution. Once all other recipients have endorsed the payment, the beneficiary will be able to select their preferred deposit option (e.g. ACH, RTP, virtual card, printed check).