Payouts

Checkbook offers a modern and efficient way to send and receive payments using digital checks. These aren’t your grandfather’s paper checks – they leverage the speed and convenience of the internet while retaining the familiarity and acceptance of a traditional check. Simply enter the recipient’s name, email or phone number, and amount to send a payment. Recipients instantly receive a customizable notification and can choose their payment preference (e.g. ACH, RTP, push to card, virtual card, printed check).

Digital checks will often be used interchangeably with “payments” or “checks” but all refer to the digital method Checkbook uses to send a payment.

How Digital Checks Work

Sender Initiates Payment

The sender uses the Checkbook platform (either through the dashboard or via API integration) to create and send a digital check. This involves specifying the recipient’s name, the payment amount, and optionally a memo.

Recipient Notification

Checkbook handles the delivery of the digital check to the recipient. This can occur via:

- Email: The recipient receives an email notification with a secure link to view their digital check.

- SMS: The recipient receives a text notification with a secure link to view their digital check.

Recipient Experience

- View the Check: The recipient clicks the secure link to view additional information and select the deposit option.

- Deposit Options: The recipient typically has several options for receiving the funds:

- Electronic Deposit: They can securely enter their bank account details through the Checkbook interface to have the funds directly deposited into their account (ACH transfer).

- Print and Deposit: While the process is digital, Checkbook often provides a printable version of the check that the recipient can physically deposit at their bank.

- Mail: Despite the digital offerings, recipients may still wish to receive a paper check in the mail. Checkbook will print and mail the check to the recipient’s mailing address.

Deposit

Once the recipient chooses a deposit method and provides the necessary information (if required), Checkbook initiates the transfer of funds from the sender’s funding source to the destination selected by the recipient.

Additional Security

Recipient PIN

For enhanced protection, the sender can optionally associate a recipient PIN (Personal Identification Number) with the digital check. This PIN is a secret code the recipient must enter before depositing the payment, preventing unauthorized access even if the initial notification is intercepted.

Sender Sets PIN

When creating a digital check, the sender has the option to set a unique PIN for that specific check. The sender must communicate this PIN to the recipient through a separate and secure channel (e.g., phone call, secure messaging).

Recipient Notification

The recipient receives the usual notification with a link to view the digital check.

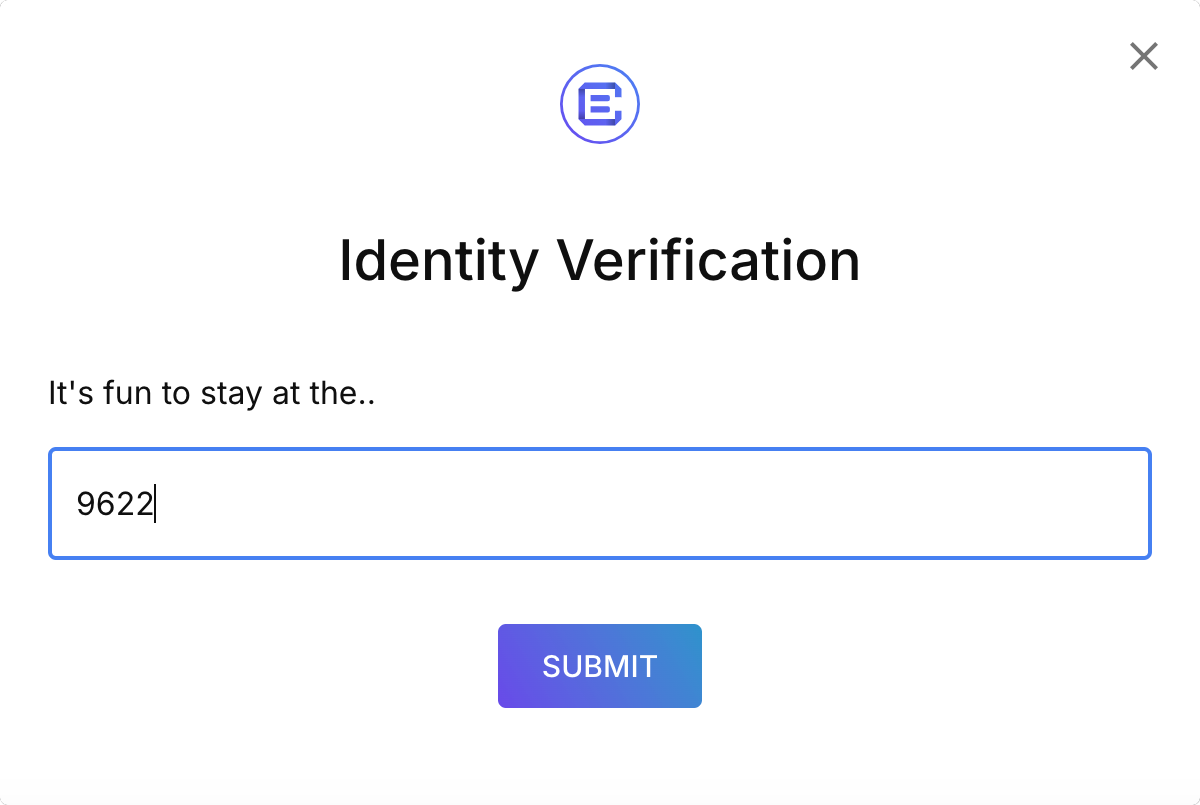

PIN Entry Required

Before the recipient can view the check details or proceed with deposit options, they are prompted to enter the PIN.

Verification

The Checkbook system verifies the entered PIN against the one set by the sender.

The system enforces limits on the number of incorrect PIN attempts to prevent brute-force attacks.

Access Granted

If the PIN is correct, the recipient gains access to the digital check and can deposit the payment.

Access Denied

If the PIN is incorrect, access is denied, and the recipient may have limited attempts before being locked out.