EFT

EFT in Canada refers to the electronic transfer of funds directly from one bank account to another. It’s similar to the Automated Clearing House (ACH) system in the United States, but operates in Canadian dollars (CAD) within the Canadian financial network. Governed by Payments Canada, it provides a way for banks and other financial institutions to move money electronically between accounts by “pushing” funds to recipients and “pulling” funds from senders. EFT is commonly used for:

Paying Vendors: Settle invoices with suppliers

Processing Customer Payments: Receive payments from customers

Handling Expenses: Manage expense reimbursements

Limits

The limit for an Canadian EFT transaction is $99,999,999.99. While this is the rail-level maximum, Checkbook limits still apply.

Timing

| Batch Cutoff | Checkbook Processing | Estimated Settlement |

|---|---|---|

| 3:00 PM PT | Same business day | Next 1-3 business days |

Details

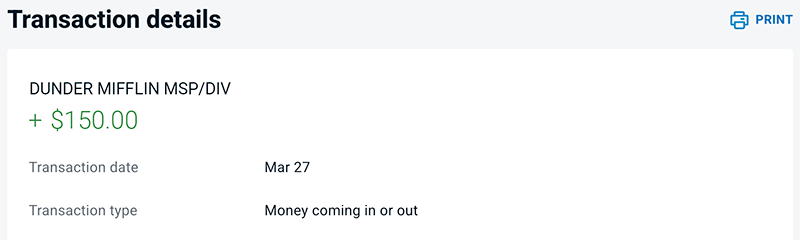

When an EFT transaction arrives at your bank, it will appear on the bank statement as an electronic deposit/withdrawal.

The specific formatting and information displayed can vary slightly depending on your bank, but you’ll generally see some combination of the following:

Amount: The amount of the payment will be clearly displayed.

Company Information: This field will usually indicate the source of the funds. Instead of a personal name, it will often show the name of the company or entity that initiated the payment. For example, if Checkbook was used by “Dunder Mifflin” to pay you, you might see “EFT CREDIT DUNDER MIFFLIN”.

Date: The date of the funds transfer.

Remittance Information: If the sender included a description with the EFT payment, this might appear in a separate “Memo,” “Reference,” or “Additional Information” field on your statement. The visibility and length of this information can vary between banks.