Interac e-Transfer

Interac e-Transfer is a Canadian email money transfer service that allows individuals and businesses to send and receive money almost instantly 24 hours a day, 7 days a week using online banking. It’s a popular and widely used method for electronic payments in Canada. Common use cases for Interac include:

Online Purchases: Pay for goods and services

Bill Payments: Conveniently pay various bills, such as utilities, phone, or credit card bills

Business Payments to Individuals: Pay freelancers and contractors for smaller invoices

Limits

Interac sets a per-transaction Canadian dollar limit for e-Transfer transactions at $25,000 per transaction. While this is the rail-level maximum, Checkbook limits still apply.

Details

Interac e-Transfer offers two distinct ways for recipients to receive funds: traditional and autodeposit. Understanding these flows is crucial for both senders and recipients to ensure smooth and timely transactions.

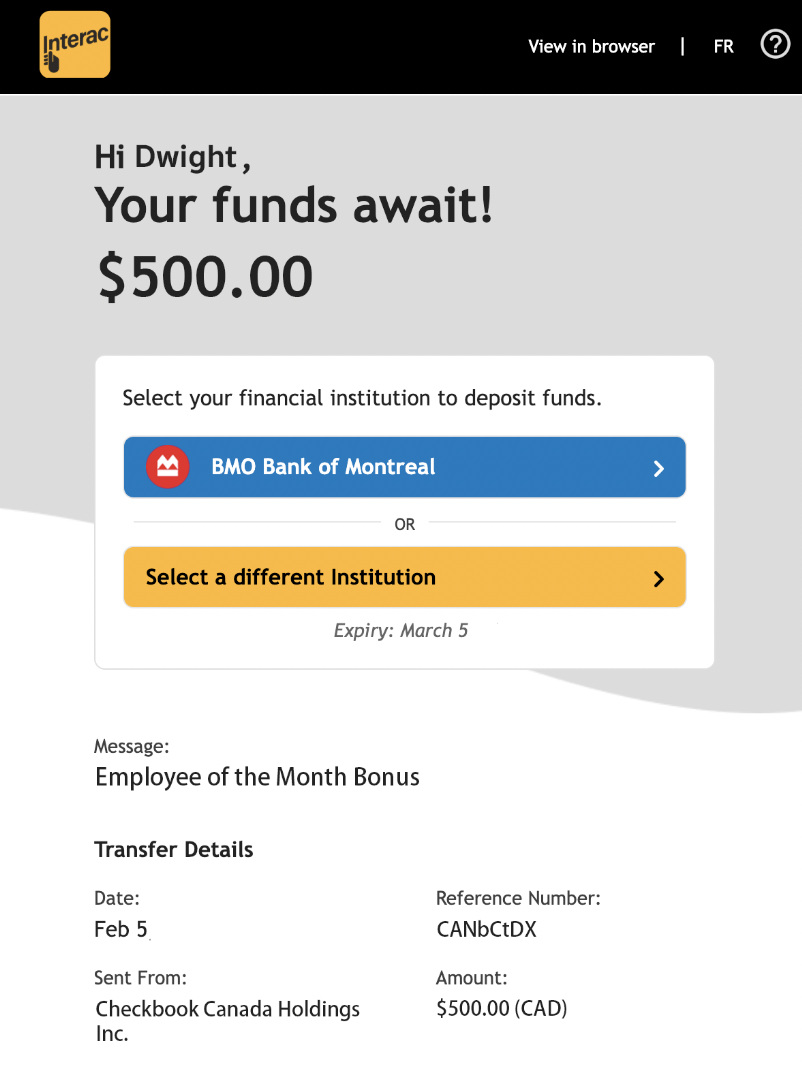

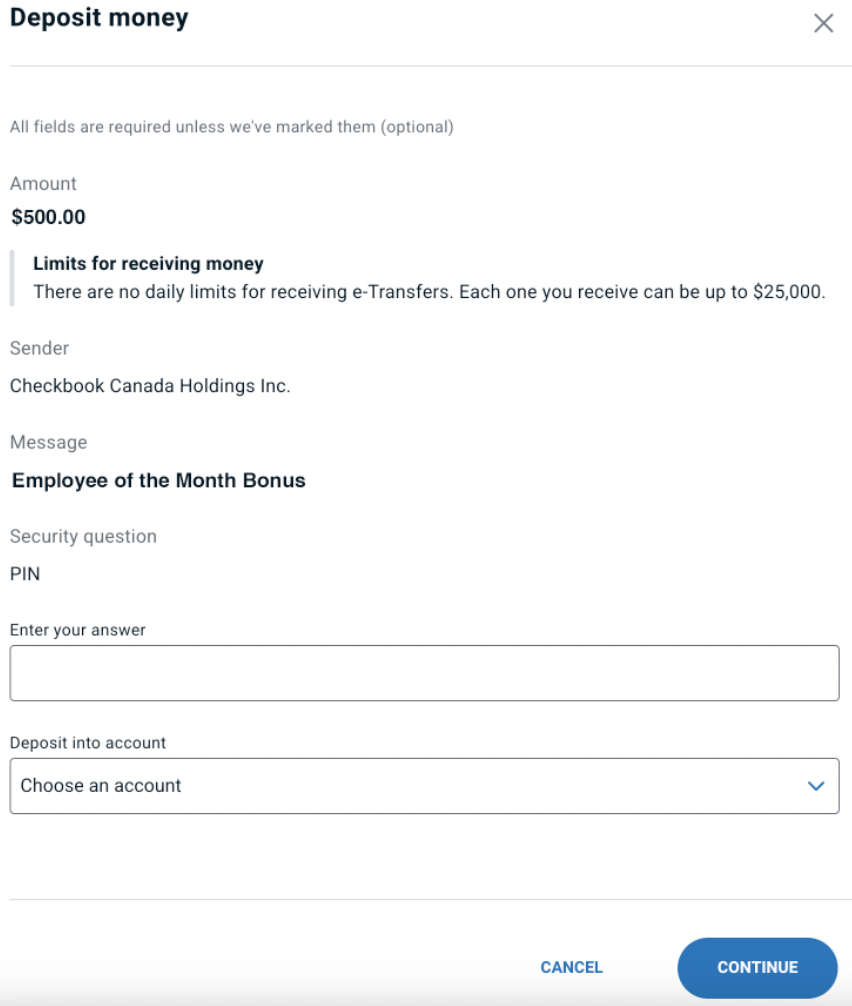

Traditional

The original and still widely used Interac e-Transfer flow requires the recipient to actively claim the funds after receiving a notification. As part of this process, the recipient may be asked to enter a verification PIN. This PIN is generated by Checkbook, and is presented via the recipient experience and API.

| Verification | |

|---|---|

|  |

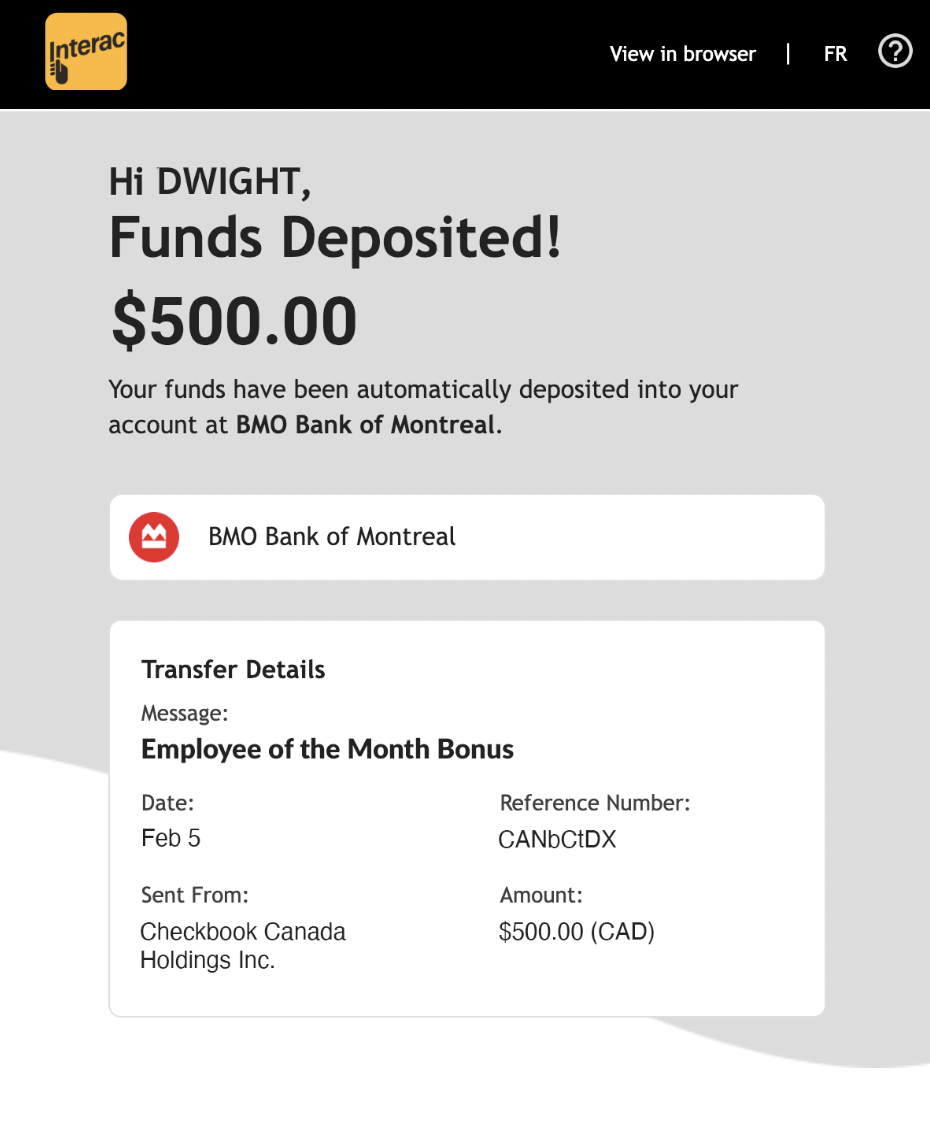

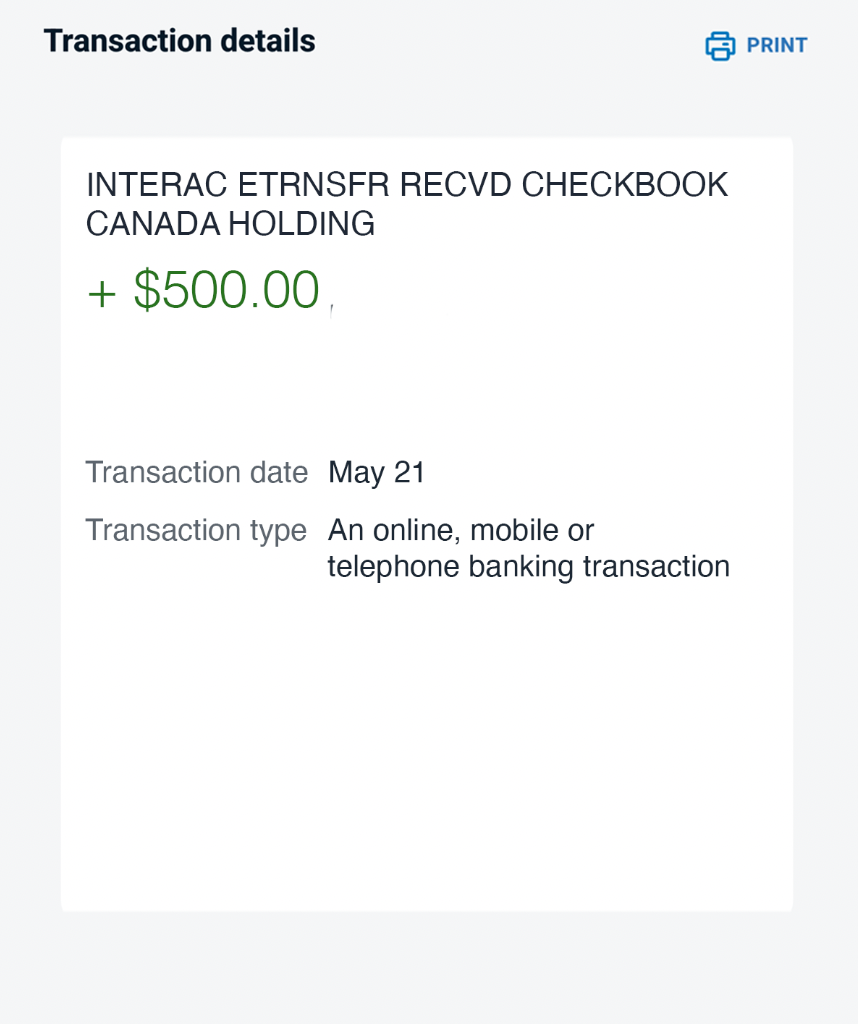

Autodeposit

When an Interac e-Transfer is sent to the email or phone number linked to the recipient’s Interac account, they will receive an email notification from Interac and the funds will be automatically deposited directly into their associated bank account:

| Account | |

|---|---|

|  |