RTP

Checkbook offers the capability to send payments via the RTP® (Real-Time Payments) network, providing near-instant transfer of funds to bank accounts at participating financial institutions. Operated by The Clearing House, this payment rail offers significant speed advantages over ACH, and is available 24 hours a day, 7 days a week. RTP payments are commonly used for:

Urgent Payments: Facilitate time-critical payments that require immediate settlement.

Real-Time Disbursements: Enable businesses to disburse funds to recipients instantly (e.g., insurance claims, payroll).

Improved Cash Flow: Enhance cash flow management by accelerating the movement of funds.

A list of participating financial institutions can be found on The Clearing House’s website .

Limits

The Clearing House sets a per-transaction dollar limit for RTP transactions at $10,000,000 per transaction. While this is the rail-level maximum, Checkbook limits still apply.

Details

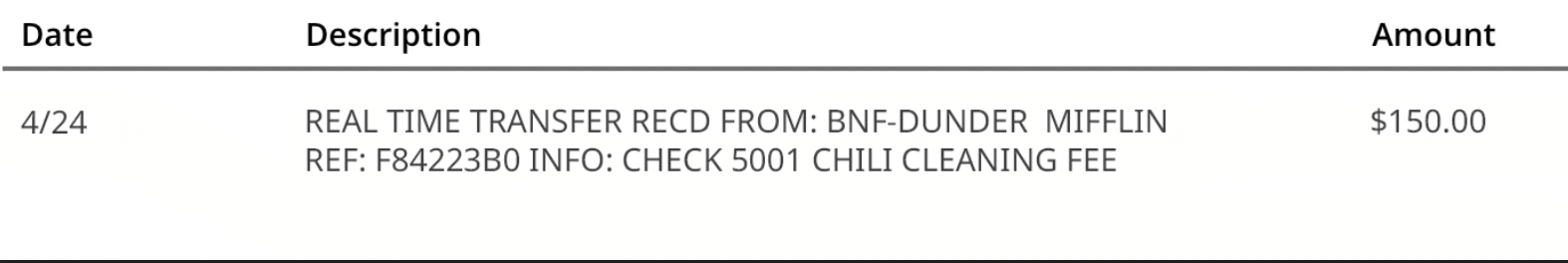

When a payment is sent via RTP, it will appear on the bank statement as a near real-time electronic deposit.

The specific formatting and information displayed can vary slightly depending on your bank, but you’ll generally see some combination of the following:

Amount: The amount of the RTP payment will be clearly displayed.

Company Information: This field clearly identifies the sender of the RTP payment, including the name of the individual or business that initiated the transfer. The formatting might be more specific and less abbreviated than standard ACH descriptions.

Date: The date of the funds transfer. Given the real-time nature, your bank statement might even include the specific time the funds were credited to your account, in addition to the date.

Transaction Type: Your bank statement will likely label the transaction distinctly as “RTP Credit,” “Real Time Transfer,” or a similar clear identifier to differentiate it from other types of electronic deposits like ACH.

Remittance Information: RTP supports text-based information within the payment message. Senders have the ability to include more detailed remittance information, invoice numbers, or brief descriptions. This might appear in the description field or in a clearly labeled “Reference”, “Memo”, or “Additional Details” section.