Wire

Checkbook offers payments via wire transfers, providing a secure and reliable method for high-value or time-sensitive transactions. Wire transfers are electronic transfers of funds through a network of banks or transfer agencies. They are generally considered a fast and secure method for transferring large sums of money. Wire transfers are commonly used for:

Large-Value Transactions: Sending or receiving significant sums of money

Time-Sensitive Payments: Situations where funds need to be transferred quickly

Timing

| Cutoff Time | Checkbook Processing | Estimated Settlement |

|---|---|---|

| 3:00 PM PT | Same business day | Same business day |

Details

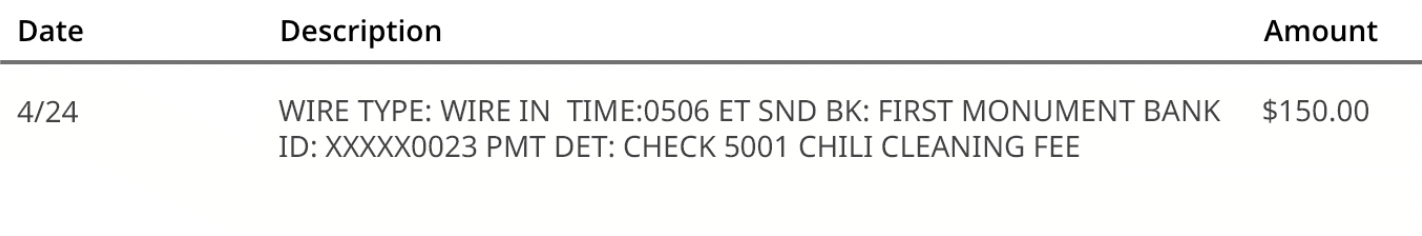

When a payment is sent via wire, it will appear on the bank statement as a wire credit.

The specific formatting and information displayed can vary slightly depending on your bank, but you’ll generally see some combination of the following:

Amount: The amount of the wire payment will be clearly displayed.

Date: The date of the funds transfer. Given the time-sensitive nature, your bank statement might even include the specific time the funds were credited to your account, in addition to the date.

Transaction Type: Your bank statement will likely label the transaction distinctly as “Wire In,” “Wire Credit,” or a similar clear identifier to differentiate it from other types of electronic deposits.

Remittance Information: Wires support text-based information within the payment message. Senders have the ability to include more detailed remittance information, invoice numbers, or brief descriptions. This might appear in the description field or in a clearly labeled “Reference”, “Memo”, or “Additional Details” section.